“It’s better to debate a question without settling it than to settle a question without debating it”

Joseph Joubert

The allure of private investments has captivated individual investors. Not long ago, investments in venture capital, private equity and private credit were exclusive to large institutions such as endowments and sovereign wealth funds. These institutions were willing to lock away their capital, often for a decade or more, with the expectation of outsized returns — a principle known as the “illiquidity premium.” As institutional investors reached their maximum allocation limits, titans including Blackstone, Apollo and KKR turned their attention to a crowd they once disregarded — the individual investor. With Bain Consulting projecting individual wealth to soar to $230 trillion by 2030, these private investment firms see the individual investor as their path to continued growth. Unsurprisingly, many financial advisors, keen on stable, recurring fees, are enthusiastically investing their clients’ assets into these illiquid funds. What was once exclusive has become pervasive, and the once-sacred “illiquidity premium” has morphed into an “illiquidity discount”, a toll individuals seem willing to pay for the privilege of access to private investments. The question of allocating to such investments has been settled without debate.

What you see isn’t what you get

Valuing a private company comes with its own complexities. Unlike publicly traded stocks, there is no ticker symbol you can easily look up to see the last trade price between buyers and sellers. The methodologies used often involve significant judgement calls on the part of the valuer. For instance, determining the appropriate ‘comparables’ or deciding the correct discount rate is often more of an art than science. The practice is further complicated by the inherent biases of private fund managers, who may be incentivized to report higher valuations to attract capital or appease existing investors. Case in point, here is a snippet from KKR’s 2022 Annual Report (it’s on page 166…we doubt many noticed).

“For the year ended December 31, 2022, the value of our traditional private equity investment portfolio decreased by 14%. This was comprised of a 57% decrease in share prices of various publicly held investments and a 1% decrease in value of our privately held investments.”

KKR claims their public stocks, whose values are determined by the market, were down 57%, but their private holdings were down just 1%. This can mean one of two things: 1) either KKR’s ability to pick public stocks is vastly inferior to their private capabilities, or 2) the prices of their private holdings are artificially inflated. Considering PE firms charge fees based on the value of their funds, we think it’s 2.

A byproduct of stale valuations is the illusion of lower risk. Because private companies aren’t frequently appraised, their value appears to remain stable over time. Their actual worth is fluctuating continuously; it’s just not visible. This can lead to the misconception that they are less risky than they truly are.

Private equity firms use these quirks to their advantage. In 2022, a year when public equities were down 20%, the average private equity fund reported performance of positive 3%. Inflated valuations allowed private equity funds to raise over $1 trillion in new assets that year, which leads us to our next concern.

Secondary Funds

“Some parts of the private-equity market are beginning to resemble a Ponzi scheme. The vast majority of deals currently are being done between private equity firms. One private equity firm will sell to another who is happy to pay a high price as they have attracted a lot of investors. When you know you are able to exit your stake to another private equity house for a multiple of, let’s say, 20, 25 or 30 times earnings, of course you won’t mark down your book. That’s why I’m talking about a Ponzi because it’s a circular thing.”

Vincent Mortier, CIO, Amundi Asset Management

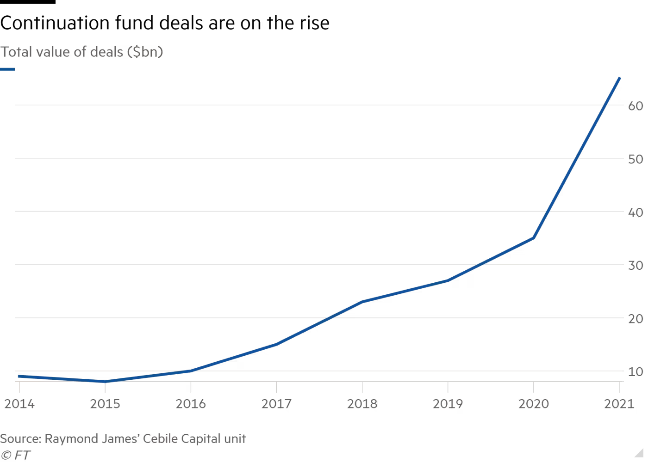

Secondary Funds (aka Continuation Funds) are the subject du jour in private equity. They’re marketed as an ingenious structure that does away with many of the drawbacks of private investing, such as the “J curve” – a typical pattern of initial low returns during the investment period that gradually improves over time. But wait, there’s more. You don’t have to be a qualified purchaser, which requires a net worth of $5 million, and you can buy into these funds for as low as $25,000. All that sounds great, until you consider the incentives at play.

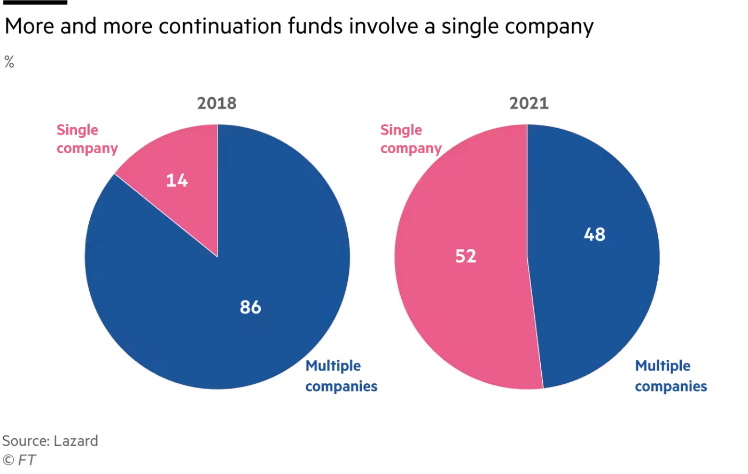

Private equity funds typically charge annual management fees of 1.5% to 2% of committed capital. After the fund has spent its initial four to six years buying companies, it switches gears, charging fees on the amount of capital invested. The bottom line? A drop in management fees in the latter half of a fund’s life cycle as the fund is exiting investments. Enter secondary funds. Rather than sell a company, a private equity firm can continue to hold onto the asset via a secondary fund. And instead of charging fees on older, often lower, acquisition costs, secondary funds calculate fees on the higher amount they pay for the company. It’s a savvy play, not just on management fees, but also on “carried interest”– the lucrative 20% share of profits. Private equity firms get a shot at earning this twice: first, when a portfolio company is moved to a secondary fund, and again when that company is ultimately sold. Selecting which investments go into the secondary fund comes with its own adverse incentives. Carried interest payments are generally paid only if a private equity fund delivers an agreed-upon return to investors. If a fund is at risk of not hitting that benchmark but houses a standout performer, shifting that asset to a secondary fund can help ensure private equity executives get their lucrative carried interest payouts. It’s no surprise secondary funds have gained a lot of traction. What’s more, over half of transactions occur between funds managed by the same private equity firm. Talk about perverse incentives.

Private Credit

The standard private equity playbook is to buy high cash flow businesses and add debt, lots of it. Private companies typically have debt ratios exceeding five times their earnings, compared to three times for their publicly traded counterparts. What’s worse, these calculations are frequently based on optimistic adjustments to earnings, suggesting true leverage ratios are even higher. Floating-rate debt has been the instrument of choice for private equity owned companies. As reference rates have jumped by over 5%, higher interest payments have negatively impacted profitability, raising concerns over the financial stability of these companies. The longer interest rates stay elevated, the more pressure heavily indebted companies will face, leading to an increase in default rates. The bankruptcy filing of Envision Healthcare in May 2023 is one such example. The private equity firm that acquired the company in 2018 now stands to lose its $3.5 billion investment, as Envision Healthcare could no longer support its overwhelming debt burden of $7 billion. And the name of that private equity firm? It’s none other than KKR.

Over the past decade, private credit funds zealously competed to lend to private equity. The rush to get in on the action led to loans that were frequently “covenant lite,” lacking the traditional safeguards meant to protect lenders. A decade ago, you’d be hard-pressed to find a loan without such covenants. Now, they make up nearly all of the loans used in buyout deals. This is particularly troubling because, legally speaking, shareholders and creditors don’t enjoy the same protections. Shareholders are often protected by rules that ensure a company’s management team acts in their best interest. On the other hand, those who lend money to a company are protected only by what’s written in their loan agreements. When problems arise, courts usually look at the wording of these contracts, rather than trying to figure out what’s fair. This can sometimes lead to surprising and unfair outcomes. Keep in mind that private equity firms employ an arsenal of sophisticated capital structure strategists and top-tier legal advisors. These firms have honed their skills in acquiring companies, piling on debt, and deftly maneuvering within the bounds of the law to optimize returns. In times of stress, lenders partnering with such adeptly managed companies may inadvertently find themselves on the less favorable end of their clever strategies.

Private credit firms apply leverage at the fund level to generate yields north of 10%, which can exacerbate a stressful market environment. Elite fund managers secure term financing, thereby syncing their debt maturities with the lifecycle of their loan portfolios. However, not all fund managers have this luxury. Some must borrow from sources that attach restrictive covenants to their debt, which means if the businesses to whom the fund has lent money start to default, the fund’s own lenders can suddenly decide to cut back their financing. When this happens, the fund must quickly sell the loans it had given out to pay back its own borrowed money. The problem is that these loans aren’t easily sold, forcing the fund to sell at prices unfavorable to its investors.

In summary, the combination of higher interest rates, excessive leverage, a history of lenient underwriting, and the intricacies of fund-level leverage warrant caution over this space.

Assessing the Opportunity

The landscape for private equity and credit investments is rapidly changing. The strategies that performed well in a market characterized by low interest rates may not hold water in the emerging era of high interest rates and economic headwinds. Opportunities still exist. For instance, turmoil across regional banks has reduced traditional lending, creating opportunities for alternative forms of credit. However, the surge of capital flowing into private equity and credit threatens to undermine investment discipline. In this saturated market, choosing the right manager is increasingly paramount. Unfortunately, it’s a classic case of adverse selection, as top-tier funds are usually oversubscribed, serving only a handful of elite institutional investors. As Groucho Marx humorously put it, “I refuse to join any club that would have me as a member.”